I’m thinking ahead about the things I want to accomplish in 2018, and they’re kind of big ones.

Before I set anything down on paper (pixels?) I wanted to go through a process to make sure they were well-defined. See, one of the reasons I struggled with some of my goals in 2017 was that they weren’t specific and measurable. I know darn well that goals have to be both in order to work out, and I STILL didn’t do the right work to think them through.

In thinking through 2018, I relied heavily on this post from The Simple Dollar: Developing a Real Plan for a Better Life.

One of the first things that post suggests you do is to define roles in your life, and write out what your life would be like in those areas in five years if everything goes just as you would hope.

Obviously I have lots of parts to my life, and not all of them are featured here on this blog. For the purposes of this exercise, I’ll write out paragraphs for three: horses, finances, and house projects.

we were so young and unfashionable and he took off like a bat out of hell about 10 seconds after this picture was taken ❤

Horses

In five years, if everything goes well, I’ll have figured out a retirement situation for Tristan and a way to fund it. He will be 28. I don’t know for sure whether or not he will be retired. If he is, then he will be in that situation; if not, it will be ready and waiting for him. (The more likely version is that he will be retired.) In that vein, I will have plans ready for a new horse: I’ll know what I want, and be ready to buy when the time is right to retire Tris.

In the intervening years, I will have kept Tristan happy, healthy, and going well. I want him to have confirmed First Level movements and be overall strong and supple. I want my own riding skills to be broader and deeper so that I can expand the pool of what I want to look at for my next horse.

I want to have his savings account fully funded, and to have a line of income dedicated to him that either has funded an initial retirement account OR funds it continually. This may be investments, an ongoing business, or some combination of both.

I want to be ready, by the time I get a new horse, to also purchase a new truck and trailer, because the new horse will be an active showing horse.

this went really well in 2017, and I have high hopes for 2018!

Finances

In five years, I’ll have all my emergency funds fully topped off, have fully saved for a new truck and/or new car, and will generally have an overall more stable financial life. In a perfect five years, I will also have our mortgage paid down 50%. (This would represent a perhaps 50% increase over our current paydown rate, which is already accelerated. )

As mentioned above, I will have a developed side line of income that is horse-specific. I’ll have saved enough to make Tristan’s retirement + a new horse a reality.

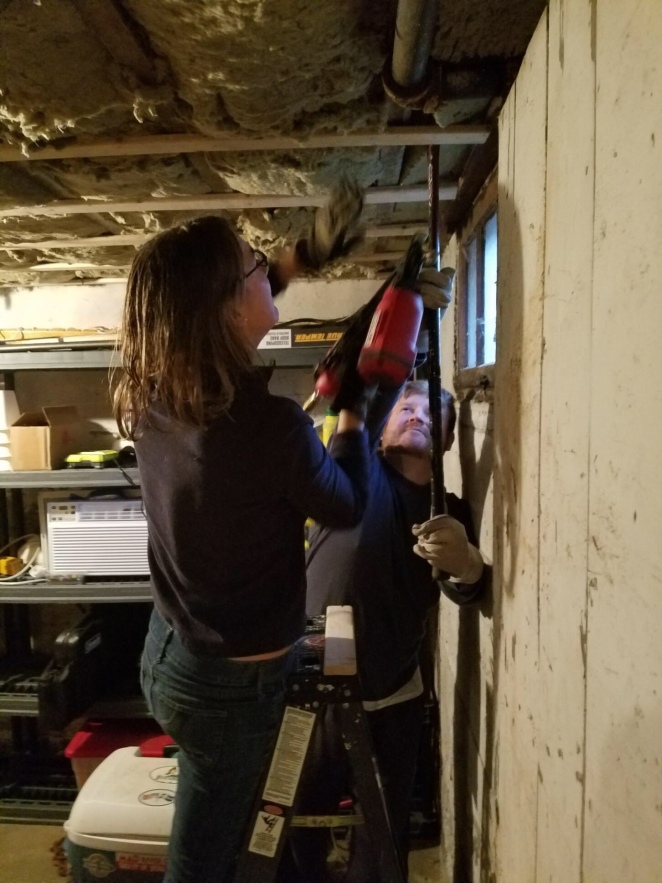

houses are stupid, the end.

House Projects

In five years, the house will be done, and we will be ready to do a major upgrade of some kind.

What do I mean by done? All wallpaper will be removed. All holes will be patched. All short-term projects will be completed. Landscaping will be sorted. Bathrooms will be renovated. Attic will be finished.

In terms of a major upgrade, we’re probably looking at kitchen upgrades, an exterior paint job, new carpet, and potentially some upgrades in the library. I’ll have this list finessed over the coming years, with quotes etc.

So, next step: break these down into their 5 year component parts, and assign specific, measurable, timely goals for 2018.

I think these are great goals! I like the 5 year plan aspect to them!

LikeLike

Thanks!

LikeLike

I love it. I’m very much on the same page with you on a lot of these: fully funding both my 401k and IRA as of this year, fully funded emergency fund in 1 year, fully funded “new truck fund” sometime in the next five years so I can be ready when my 2005 goes. Oh and that whole “renovating a historic home thing” that costs a few pennies too, lol. I feel like as horse owners we have an obligation to be financially responsible so we can deal with the very big very real curveballs horses can throw at us, you’re doing a good job with it!

LikeLike

Yes, I consider being financially responsible just as important as being a good rider, etc. I’ve worked in nonprofits my whole career, so I’ve been forced to be careful with every single penny from day 1. It allows me a lot more flexibility and freedom than I would have otherwise.

LikeLike

This is a good way to think. But also intimidating. I don’t really know how to make these plans right now… everything is a bit unstable. However, that might just be an excuse. So I should probably do this exercise myself.

LikeLike

It was intimidating, for sure! And I’m usually very much a long term planner and goal person! It was useful, though. Even just starting to write things out got my brain started.

LikeLike

This post pleases the anal-retentive side of me so, so much. I love the financial planning side to the goals – that is very wise. It’s really motivating to do some similar type of planning in my own life.

LikeLike

I’d love to hear about what you are thinking!

LikeLike